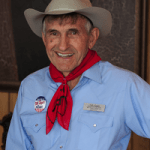

Peggy Doviak

- Advisor for Corporate Headquaters & major brokerage/advisory firms

- Certified Financial Planner

Peggy Doviak was a college instructor and corporate trainer before she entered finance in 2002. She is an Associate Professor for the College for Financial Planning in Denver, Colorado, and has taught in the corporate headquarters of Schwab, Ameriprise, Smith Barney, and other major brokerage and advisory firms. Peggy’s Ph.D. is in education, and she

read the restPeggy Doviak believes that the financial services industry needs to embrace a high level of professionalization, focusing on comprehensive financial planning and transparent portfolio management upholding a fiduciary standard. She is active in the Central Oklahoma Financial Planning Association, serving currently as Secretary. She is also a member of Nazrudin, an international think tank of financial planners. Peggy obtained her CERTIFIED FINANCIAL PLANNERTM practitioner certification in 2005. Then, she decided to enhance her portfolio management skills with a Master’s in Finance, Financial Analysis major, which she obtained in August 2010. For this degree, she completed the coursework necessary to sit for the Chartered Financial Analyst designation. She writes a monthly e-newsletter, Money Matters, which has several hundred subscribers. She is active in Norman Rotary, Chamber of Commerce, Norman Women’s Entrepreneur Network, and serves on the board of the Women’s Resource Center. D.M. Wealth Management, Inc. is proud to be a partner in education with All Saints Catholic School and to be active in the Second Friday art walks.

For fun, Peggy enjoys playing the piano, riding horses, and travelling abroad with her husband, Richard. She has two cats, Smokey and Pumpkin, and a horse named Maggie.

read less